The London Market Claims Ecosystem

An infographic mapping the intricate web of claims interconnections

The Core Participants & Their Roles

The London Market claims process is a collaborative effort, orchestrated by several key entities, each with distinct responsibilities. Understanding these roles is crucial to navigating the claims journey. This diagram illustrates the primary participants and their fundamental interactions.

The Core Claims Journey

A claim’s journey through the London Market follows a structured, technology-enabled path. While complex claims have many nuances, this flowchart illustrates the typical process for a subscription market risk, highlighting key systems and agreement protocols that ensure efficiency.

1. First Notification of Loss (FNOL)

Policyholder informs Broker, who submits the claim to the Lead Insurer via the Electronic Claim File (ECF) system.

2. Triage & Expert Appointment

Lead Insurer reviews the claim, assesses complexity, and appoints experts (Loss Adjusters, Lawyers, etc.) as needed.

3. Investigation & Quantum

Experts investigate the cause and value of the loss, reporting their findings back to the Insurer and Broker.

4. Claims Agreement Protocol

For subscription risks, agreement is streamlined. The Lloyd’s Claims Scheme or SCAP gives the Lead authority to agree the claim for following insurers.

5. Negotiation & Settlement

Broker negotiates the final settlement with the Lead Insurer on behalf of the policyholder.

6. Payment

Funds are collected from all participating insurers via central market systems (e.g., DXC) and paid to the Broker for transfer to the policyholder.

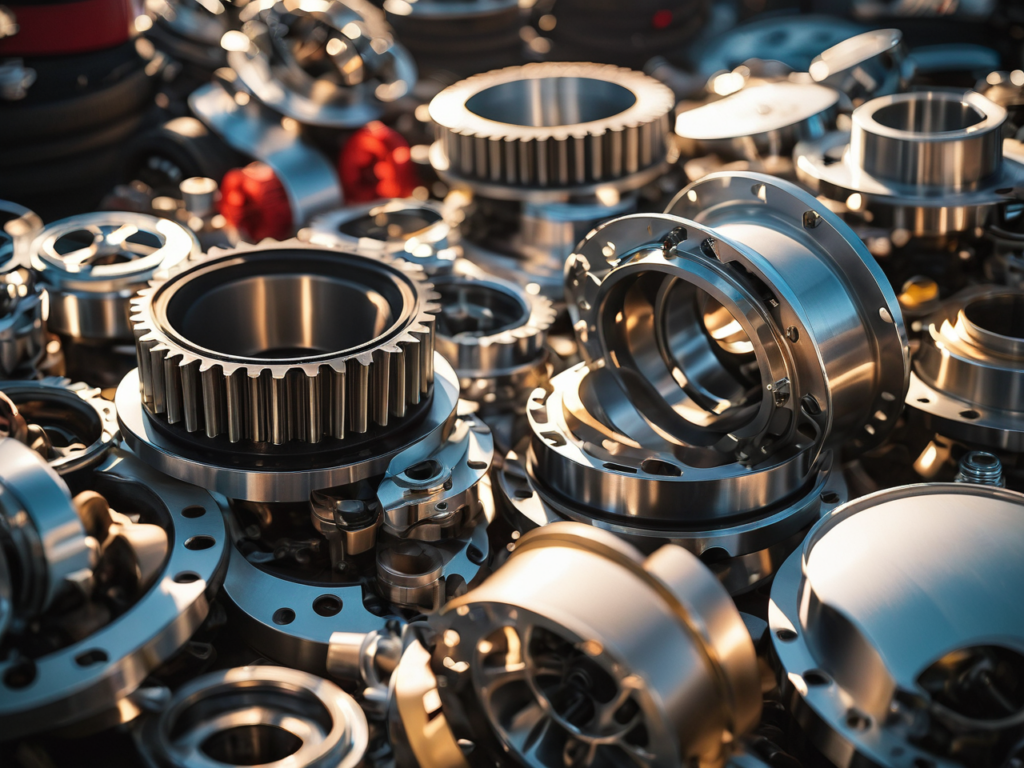

Claims Interconnections by Line of Business

The nature of the risk fundamentally shapes the claims process. Different lines of business place emphasis on different experts and interactions. Below is a comparison of how the claims ecosystem adapts to various specialty risks.

Commercial Property & BI

Claims are driven by physical damage. The process is dominated by on-site investigation to determine the cause and quantify the cost of reinstatement and lost income.

Key Players:

The Loss Adjuster’s report on damage and valuation is the central document driving the claim forward, especially for property damage. Forensic Accountants are vital for complex Business Interruption calculations.

Professional Indemnity (PI)

Claims arise from allegations of professional error or negligence. The process is typically litigation-driven, focusing on legal defense strategy, coverage analysis, and expert witness testimony from the outset.

Key Players:

The immediate appointment of Legal Firms (Defense and Coverage Counsel) is the critical first step. Expert Witnesses specific to the profession involved are often crucial.

Marine (Hull & Cargo)

These claims are global, involving damage to vessels (Hull) or goods in transit (Cargo). Swift on-site assessment by technical experts (Surveyors) and understanding of maritime law are crucial.

Key Players:

Marine Surveyors provide initial damage assessments. Average Adjusters quantify complex claims like General Average. Maritime Lawyers and P&I Clubs handle liability aspects.

Cyber Risks

Cyber claims are a crisis response to events like data breaches or ransomware attacks. The focus is on immediate incident containment, forensic investigation, legal compliance, and managing reputational fallout.

Key Players:

The claim is a live incident response, managed by a panel of pre-approved specialists (Forensics, Breach Coach, PR, Negotiators) activated by the insurer, often coordinated by a TPA or specialized MGA.

Energy (Onshore/Offshore)

Energy claims often involve high-value, high-complexity events (e.g., damage to rigs, pipelines, refineries). They require deep engineering, environmental, and contractual expertise to analyze cause, control loss, and plan remediation.

Key Players:

Highly specialized engineering consultants and environmental experts are central. Specialist Loss Adjusters coordinate the multi-faceted investigation and quantification.

Reinsurance

“Insurance for insurers.” Claims are typically a B2B transaction based on the underlying claim paid by the ceding insurer. Data quality, accuracy of bordereaux, and treaty/facultative wording interpretation are paramount.

Key Players:

The claim is a data-driven process, relying on the quality of claims bordereaux from the Cedent. Reinsurers may conduct claims audits for large or unusual losses. The Reinsurance Broker facilitates communication and settlement.

Market Dynamics & Future Outlook

The London Market claims environment is not static. It is constantly evolving under the pressure of external trends and internal modernization efforts. These factors are reshaping relationships and demanding greater agility from all participants.

The chart below represents the perceived impact level of key trends on the London Market claims process, based on the emphasis within industry analysis. Higher values indicate a greater influence on changing operational dynamics and strategic priorities.

Inflation and the push for Digital Transformation (Blueprint Two) are exerting the most significant pressure, fundamentally altering claims costs and operational workflows. Climate change drives loss frequency and severity, while talent shortages pose a long-term strategic risk to the market’s expertise-driven model.