- ian@etherintroductions.com

- 07795 275934

We have undertaken extensive reviews and rate negotiations for legal services across all lines of

An infographic mapping the intricate web of claims interconnections

The London Market claims process is a collaborative effort, orchestrated by several key entities, each with distinct responsibilities. Understanding these roles is crucial to navigating the claims journey. This diagram illustrates the primary participants and their fundamental interactions.

A claim’s journey through the London Market follows a structured, technology-enabled path. While complex claims have many nuances, this flowchart illustrates the typical process for a subscription market risk, highlighting key systems and agreement protocols that ensure efficiency.

Policyholder informs Broker, who submits the claim to the Lead Insurer via the Electronic Claim File (ECF) system.

Lead Insurer reviews the claim, assesses complexity, and appoints experts (Loss Adjusters, Lawyers, etc.) as needed.

Experts investigate the cause and value of the loss, reporting their findings back to the Insurer and Broker.

For subscription risks, agreement is streamlined. The Lloyd’s Claims Scheme or SCAP gives the Lead authority to agree the claim for following insurers.

Broker negotiates the final settlement with the Lead Insurer on behalf of the policyholder.

Funds are collected from all participating insurers via central market systems (e.g., DXC) and paid to the Broker for transfer to the policyholder.

The nature of the risk fundamentally shapes the claims process. Different lines of business place emphasis on different experts and interactions. Below is a comparison of how the claims ecosystem adapts to various specialty risks.

Claims are driven by physical damage. The process is dominated by on-site investigation to determine the cause and quantify the cost of reinstatement and lost income.

Key Players:

The Loss Adjuster’s report on damage and valuation is the central document driving the claim forward, especially for property damage. Forensic Accountants are vital for complex Business Interruption calculations.

Claims arise from allegations of professional error or negligence. The process is typically litigation-driven, focusing on legal defense strategy, coverage analysis, and expert witness testimony from the outset.

Key Players:

The immediate appointment of Legal Firms (Defense and Coverage Counsel) is the critical first step. Expert Witnesses specific to the profession involved are often crucial.

These claims are global, involving damage to vessels (Hull) or goods in transit (Cargo). Swift on-site assessment by technical experts (Surveyors) and understanding of maritime law are crucial.

Key Players:

Marine Surveyors provide initial damage assessments. Average Adjusters quantify complex claims like General Average. Maritime Lawyers and P&I Clubs handle liability aspects.

Cyber claims are a crisis response to events like data breaches or ransomware attacks. The focus is on immediate incident containment, forensic investigation, legal compliance, and managing reputational fallout.

Key Players:

The claim is a live incident response, managed by a panel of pre-approved specialists (Forensics, Breach Coach, PR, Negotiators) activated by the insurer, often coordinated by a TPA or specialized MGA.

Energy claims often involve high-value, high-complexity events (e.g., damage to rigs, pipelines, refineries). They require deep engineering, environmental, and contractual expertise to analyze cause, control loss, and plan remediation.

Key Players:

Highly specialized engineering consultants and environmental experts are central. Specialist Loss Adjusters coordinate the multi-faceted investigation and quantification.

“Insurance for insurers.” Claims are typically a B2B transaction based on the underlying claim paid by the ceding insurer. Data quality, accuracy of bordereaux, and treaty/facultative wording interpretation are paramount.

Key Players:

The claim is a data-driven process, relying on the quality of claims bordereaux from the Cedent. Reinsurers may conduct claims audits for large or unusual losses. The Reinsurance Broker facilitates communication and settlement.

The London Market claims environment is not static. It is constantly evolving under the pressure of external trends and internal modernization efforts. These factors are reshaping relationships and demanding greater agility from all participants.

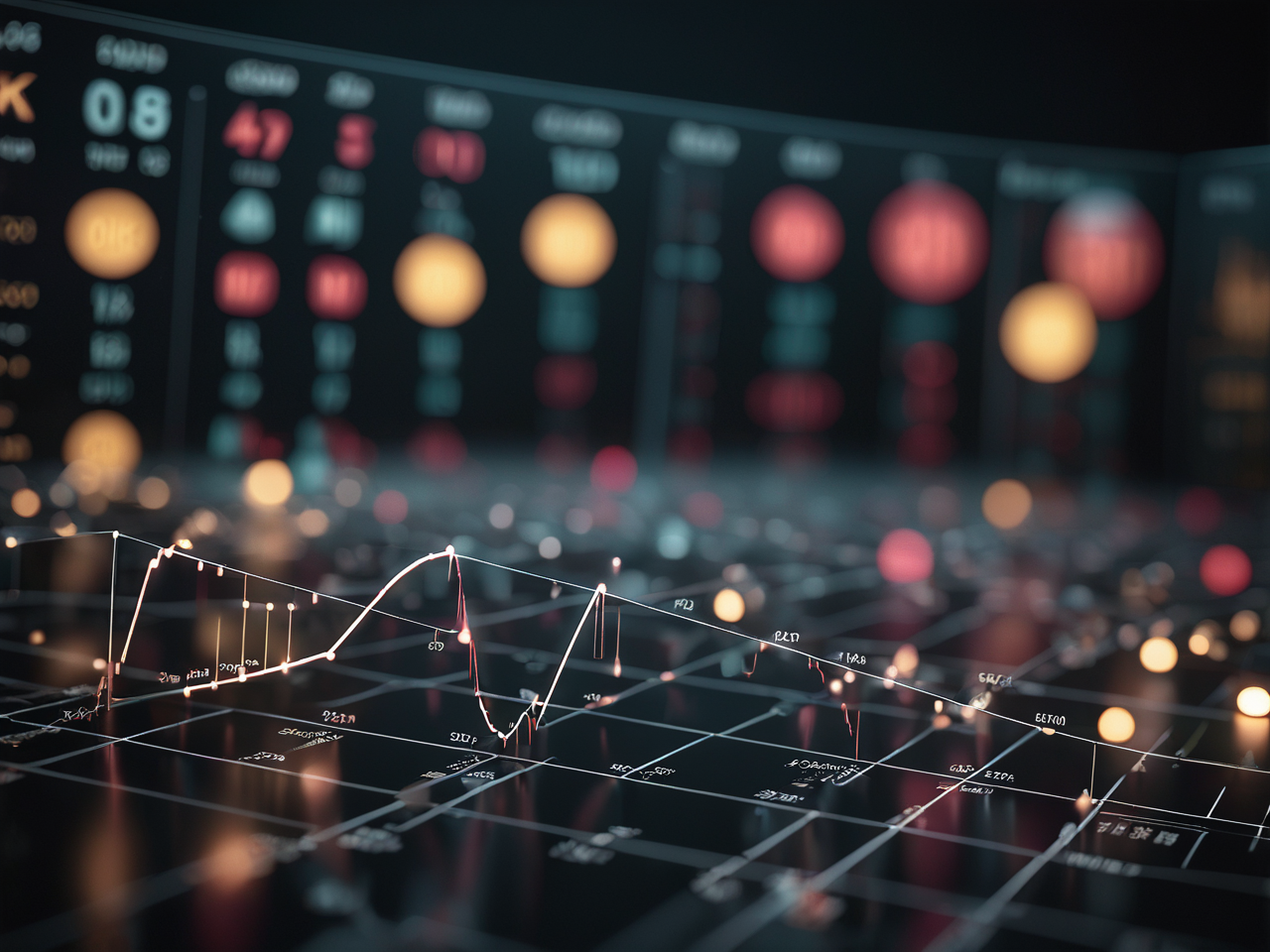

The chart below represents the perceived impact level of key trends on the London Market claims process, based on the emphasis within industry analysis. Higher values indicate a greater influence on changing operational dynamics and strategic priorities.

Inflation and the push for Digital Transformation (Blueprint Two) are exerting the most significant pressure, fundamentally altering claims costs and operational workflows. Climate change drives loss frequency and severity, while talent shortages pose a long-term strategic risk to the market’s expertise-driven model.

Category Planning

Part of the move from a reactionary supply chain function to a proactive one is the need to have a detailed category plan for all spends.

We have an in depth knowledge of insurance claims spend categories covering the key suppliers, market conditions and performance. Working with your key stakeholders we are able to provide these plans. Just as importantly, can execute them too.

A key element of any plan is a full and detailed data analysis. Not just the basic measures at this stage though. This requires a deeper dive to draw out fresh insights over cost control and performance.

Data drives everything we do, informed by years of experience. We have a deep understanding of what supplier data is telling us and the knowledge base to know how to best use it.

Systems

Running everything on spreadsheets and shared files only works for so long. We have worked on multiple vendor management platforms and e-bidding tools and been part of delivery programmes to implement them.

When they are implemented properly these platforms take the headache out of renewals and compliance. When implemented poorly everyone does everything they can to avoid the platforms so its key to get it right. Once we have received the financial data covering spend we are able to build a picture of what you are spending and where.

We have no links to any systems or platforms, nor any preferences. Each client will have different needs and levels of usage which will dictate the most appropriate systems to be employed.

Follow the money.

Starting with your own financial records and known payees, we start to build up a picture of the likely spend.

We then cross referenced this against the suppliers own financial records. In this way, a true picture of the claims supplier spend is built up.

Working with your teams, we issue Raw data requests covering not just financials but key performance data and sub-spend detail. By way of an example, this might include the office location where the work was undertaken and the partner who actually did the work.

We then are able to build up a profile of what you are spending with what firms.

A lot of time and effort can be spent here trying to get the numbers to match 100%. Our best advice is to get to a matching rate of above 80% and stop.

Build a picture of your spend.

Once we have received the financial data covering spend we are able to build a picture of what you are spending and where.

We then discuss rates and negotiate client-specific rates rather than using the “walk-in” rates that suppliers typically apply without a formal agreement.

Other activity covered;

Our aim is to get you on the correct rates with management controls in place to ensure that the suppliers are adhering to best practice.

Managing claims supply spend effectively is crucial. But before you can optimize, you need to

We have nothing but sympathy for insurance companies when the surge hits. As premiums continue

Continue readingRemaining calm in a surge – claims supply chain